Sometimes a smaller negative can be as welcome as a positive, encouraging hope that the situation just might be improving. Such is the case with new-vehicle sales in Canada in September.

September sales of 130,421 vehicles, as estimated by DesRosiers Automotive Consultants (DAC), were down just 4.5% from the same month last year—their best relative performance since January. That said, those figures were the lowest for the month since the economic crisis of 2009, and they were down 23.2% from September, 2020, the sales high-point of the pandemic period.

September’s SAAR (Seasonally Adjusted Annualized Sales Rate) was about 1.48 million, according to DAC—about where it has been throughout the quarter.

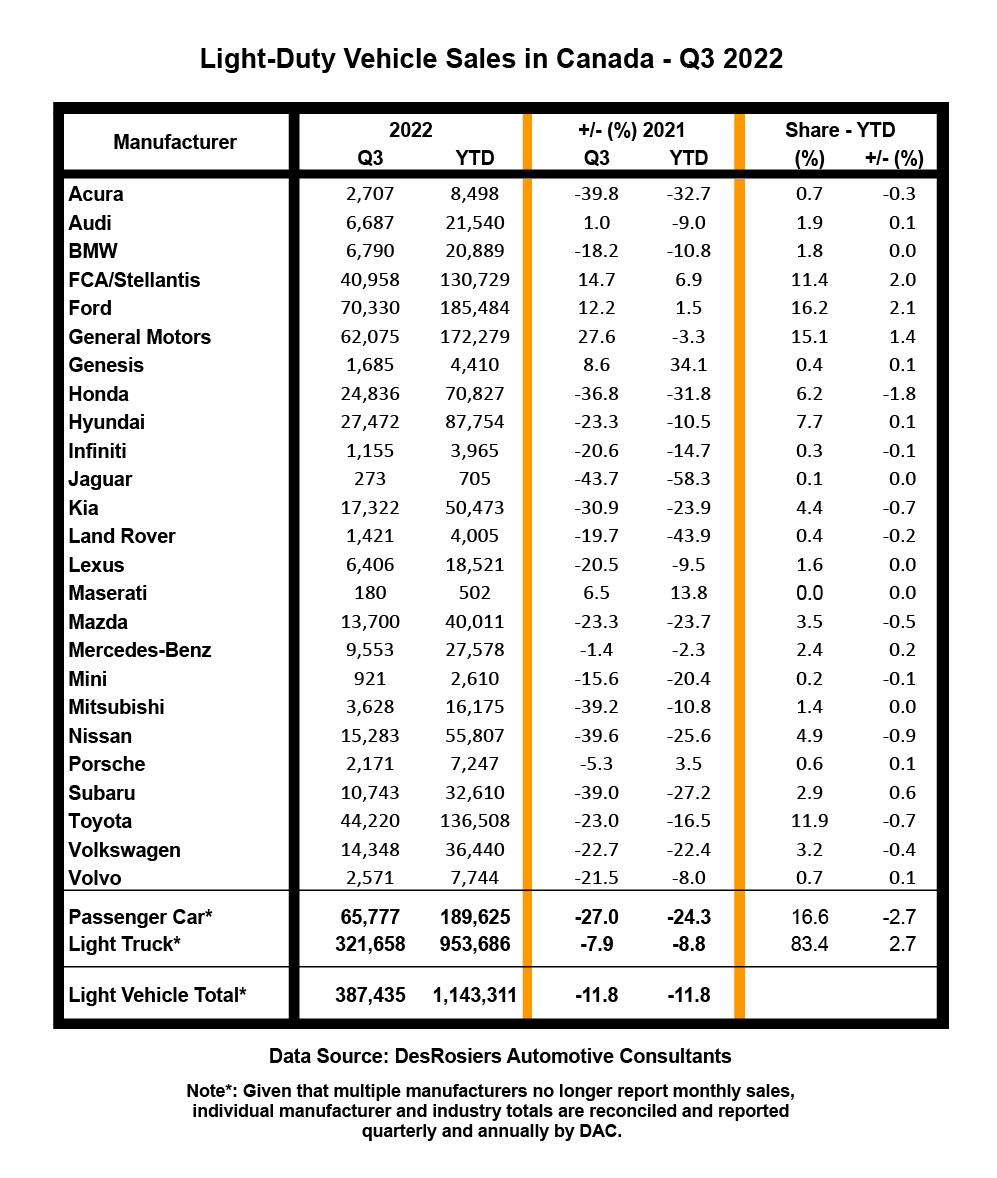

As for Q3 as a whole, its cumulative sales of 387,435 units were down 11.8% from the same period last year, and exactly in line with the decline for the full year to date.

So where is the glimmer of hope? It is in the fact that 10 of the 25 reporting brands made relative gains in Q3 and a few—the Detroit Three among them—made absolute year-over-year gains. The caveat to that accomplishment is that the industry was extremely hard-hit by semiconductor shortages in the comparative summer of 2021.

Summarizing the situation, Andrew King, Managing Partner of DAC, cautioned: “The split in performance between companies was remarkable—and it would be foolish to get too optimistic until the recovery has a broader base of participants”.

There remains a huge dichotomy between vehicle availability and pent-up demand, all complicated by a rapidly worsening economic environment, which leaves prospects for the fourth quarter as a big question mark.

Light truck share edges upward

Sales of 321,658 “light trucks” (pickups, vans and utility vehicles, including crossovers) in Q3 were down 7.9% from the same period a year ago, but their cumulative market share for the year-to-date increased by 2.7% to 83.4% of the market – still below their Q1 2021 peak of 84.4%.

Passenger car sales of 65,777 units were down 27.0% from Q3 2021, at the expense of 2.7% of market share.

Detroit Three to the fore

As noted above, the variation in results among manufacturers in Q3 was dramatic, with the Detroit Three performing particularly well compared to the rest.

Ford retained its number-one ranking for both Q3 and the year-to-date with sales of 70,330 and 185,484 units respectively, up 12.2% for the quarter and 1.5% for the year so far. Ford’s market share for the year-to-date has increased by 2.1% to 16.2% – the greatest share gain in the industry.

General Motors took clear control of second place with 62,075 sales, up 27.6%, for the quarter, and 172,279, down 3.3%, for the year-to-date. That surge improved GM’s market share by 1.4% to 15.1%.

Toyota, with or without Lexus sales included, ranked third for both the quarter and the year-to-date. The Toyota brand sold 44,220 units in Q3, a decline of 23.0%, and 136,505 for the year-to-date, down 16.5% from a year ago, cutting market share by 0.7% to 11.9%.

Stellantis claimed fourth place with 40,958 sales in Q3 and 130,729 through nine months resulting in year-over-year gains of 14.7% and 6.9% respectively, and a market share gain of 2.0% to 11.4%.

Hyundai maintained its fifth-place ranking with sales of 27,472 vehicles, down 23.3%, in Q3, and 87,754, down 10.5%, for the year-to-date. Its market share improved by 0.1% from 2021, to 7.7%.

Still turmoil further down

Having fallen to sixth place earlier in the year, Honda retained that ranking with sales of 24,836 in Q3 and 70,827 for the year-to-date – declines of 36.8% and 31.8% respectively. As a result, Honda’s market share declined by 1.8%, year-over-year, to 6.2%.

Kia clawed its way into seventh place for the quarter with 17,322 sales, a decline of 30.9%, but sales of 50,473 units year-to-date, down 23.9%, leave it ranked eighth on that basis and cut market share by 0.7% to 4.4%.

Nissan’s 15,283 Q3 sales, down 39.6% from the same period a year ago, left it in eighth place for the quarter. But its 55,807 cumulative sales, down 25.6%, kept it in seventh for the year-to-date, with a market share decline of 0.9% to 4.9%.

Volkswagen reclaimed ninth place for the quarter with 14,348 vehicles sold, down 22.7%, but remained tenth for the year-to-date, with 36,440 cumulative sales, down 22.4%. VW’s market share fell by 0.4%, year-over-year, to 3.2%.

Mazda dropped to tenth place for Q3 with sales of 13,700 vehicles, but its cumulative sales of 40,011 units maintained its ninth-place rankings for the year-to-date, with market share reduced by 0.5% to 3.5%.

Subaru remained 11th in the rankings, followed by Mercedes-Benz, which continued to head the luxury brand rankings, ahead of Audi and BMW, in a close fight for the next ranking, followed by Lexus..

Winners and losers

Given the ongoing supply-side constraints and their effects on production throughout the industry, sales numbers for any manufacturer may be a reflection of product availability rather than market demand alone.

With that caveat in mind, for Q3 2022, General Motors led the way in terms of the greatest percentage gain, up 27.6% from a year ago, followed by FCA/Stellantis (+14.7%), Ford (+9.5%), Genesis (+8.6%) and Maserati (+7.4%).

At the other extreme, Jaguar experienced the greatest percentage decline (-43.7%), followed closely by Acura (-39.8%), Nissan (-39.6%), Mitsubishi (-39.2%), and Subaru (-39.0%).