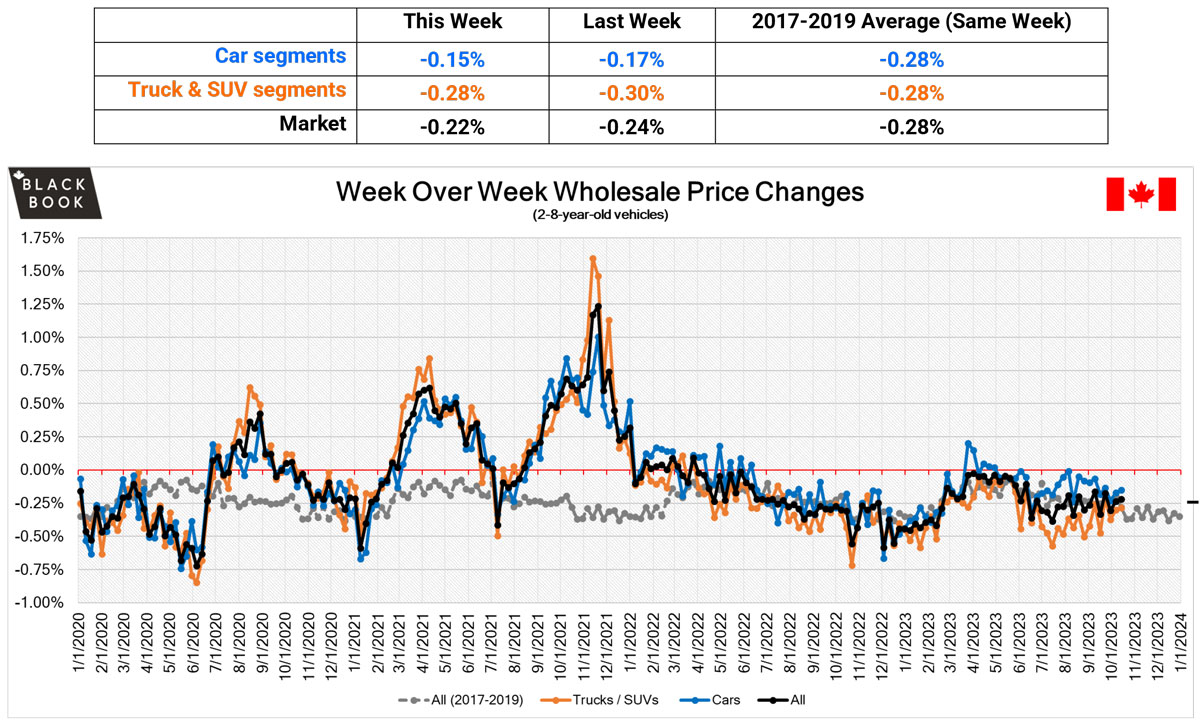

Looking at the Canadian used wholesale market for the period ending on Oct. 14, dealers will notice a decline in prices of -0.22%, which is similar to the previous week’s update from Canadian Black Book of -0.24%.

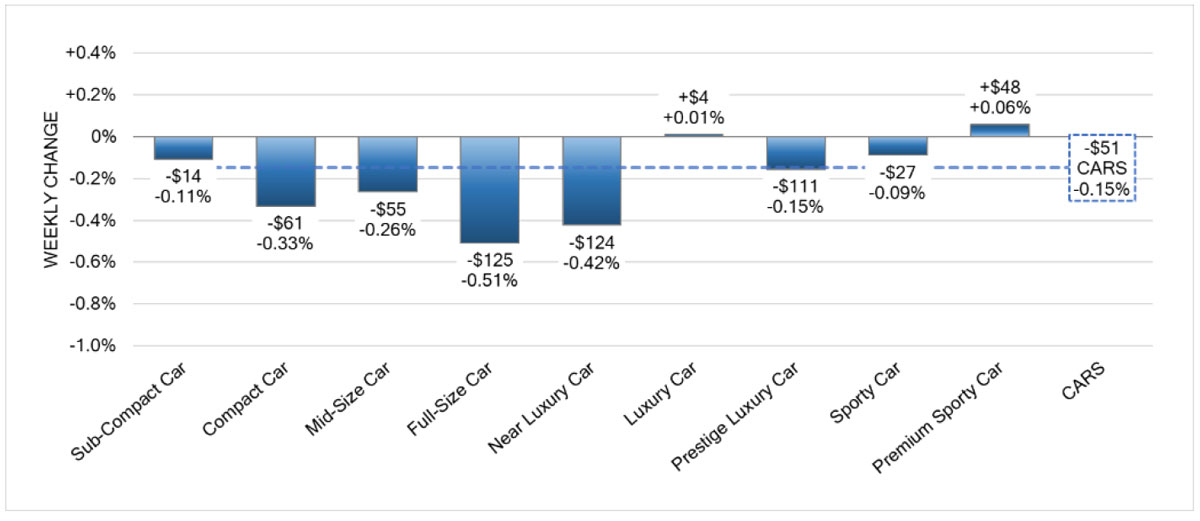

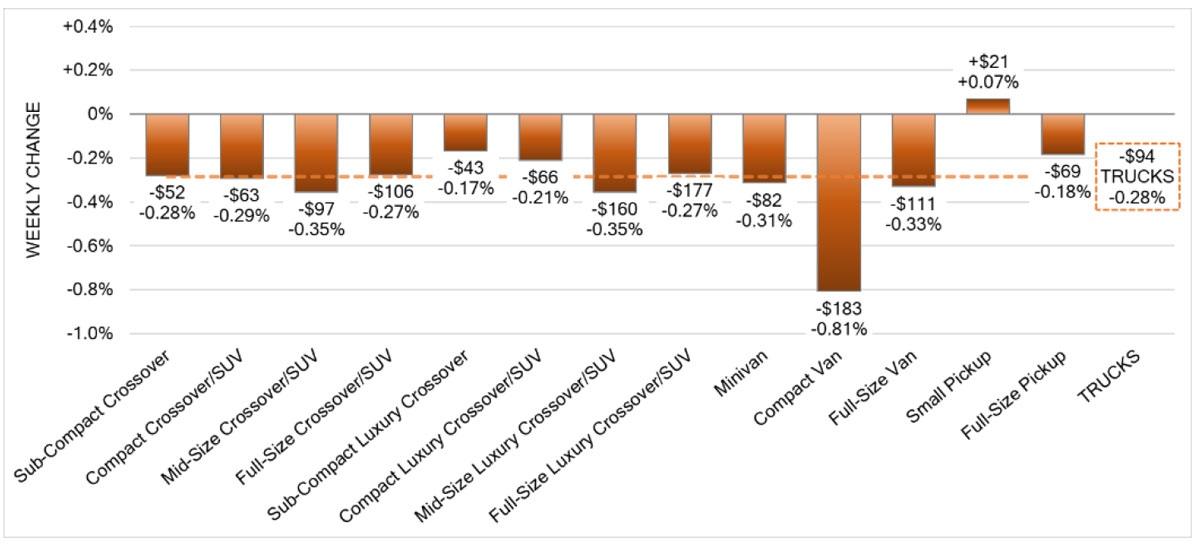

The car segment fell by -0.15% (versus the prior week’s -0.17%), while truck/SUV segment prices were down -0.28% (compared to the previous week’s -0.30%). Three out of 22 segments’ values increased for the week.

In the United States, the overall car and truck segments experienced a decreased of -0.36% last week, compared to the prior week’s -0.32%. The volume-weighted car segments were down -0.47% (versus the prior week’s -0.34%), and trucks saw a decline of -0.32% (compared to the previous week’s -0.28%).

“Supply remains low with high demand for more recent and clean condition vehicles on both sides of the border,” said CBB in its Market Insights report. “Upstream channels continue to tap supply before it can be available to wholesale markets.”

On the Canadian side, the car category saw two of its nine segments increase in pricing: premium sports cars (+0.06%) and luxury cars (+0.01%). The biggest decline came from full-size cars (-0.51%), followed by near luxury cars (-0.42%) and compact cars (-0.33%).

On the flip side, trucks/SUVs saw 12 of its 13 segments experience a decline. Compact vans again had the largest drop (-0.81%), while mid-size crossovers/SUVs and mid-size luxury crossovers/SUVs had the next largest depreciation (-0.35%). The small pickup segment was the only segment to experience an increase (+0.07%).

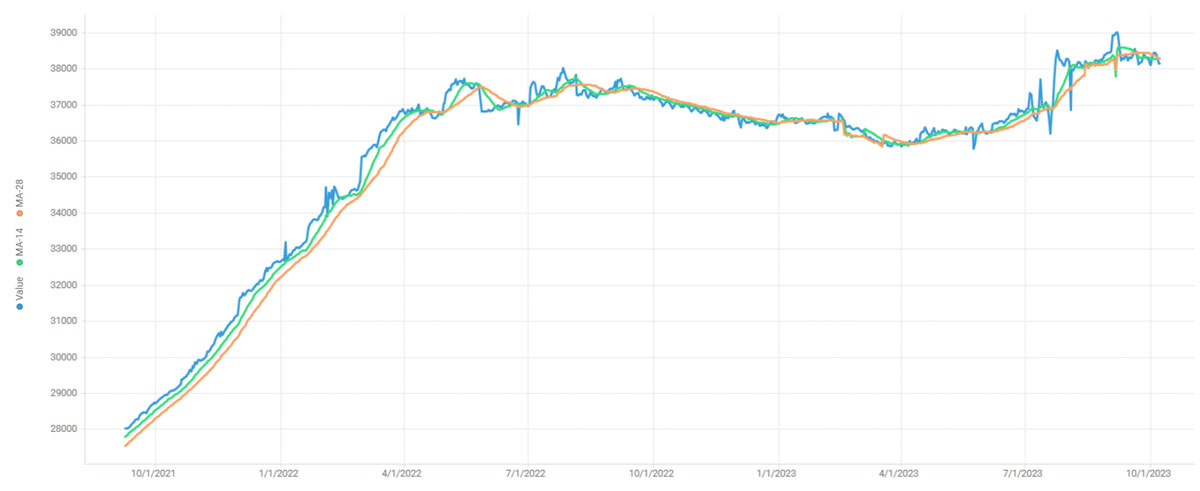

As for used retail price and listing volumes, CBB found the average listing price for used vehicles, as per the 14-day moving average, to be approximately $38,300. The analysis is based on around 195,000 vehicles listed for sale on Canadian dealer lots.

Dealers can view the full report here.