Canadian Black Book’s TalkAuto conference was held this week in Vaughan, Ont., bringing together a cross-section of attendees from the automotive ecosystem, including OEMs, lenders, industry analysts, dealers and suppliers. The jam-packed room was treated to an equally packed agenda filled with insights delivered by keynote speakers and moderated panel sessions.

Yolanda Biswah, President of Canadian Black Book, kicked off the day with welcoming remarks. “We are in the most transformative period in our industry’s history. The process of transformation can be intimidating.” But she added that the industry is poised and ready for change, and that people in the audience can be a part of making that change and transformation.

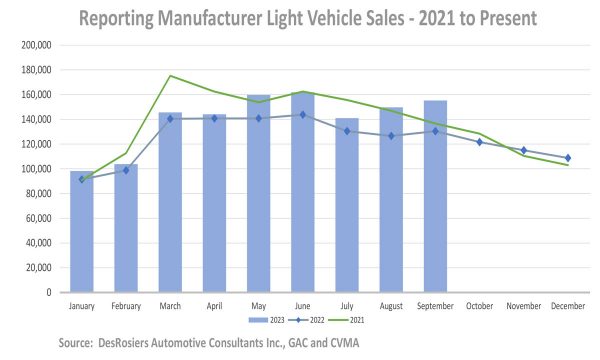

The opening speaker was Brian Kingston, President & CEO of the Canadian Vehicle Manufacturers’ Association, who offered an overview on the state of the Canadian auto industry. He said Canada’s auto industry directly employs more than 117,000 people and an additional 400,000 people are employed in aftermarket services and dealerships. “This is an industry you want in your country,” said Kingston, adding that Canada is lucky to have five OEMs operating manufacturing facilities here.

He said the auto industry has been Canada’s second largest exporter with $38 billion per year of goods, and the $30 billion of investment in new manufacturing capacity in Canada bodes well for our future.

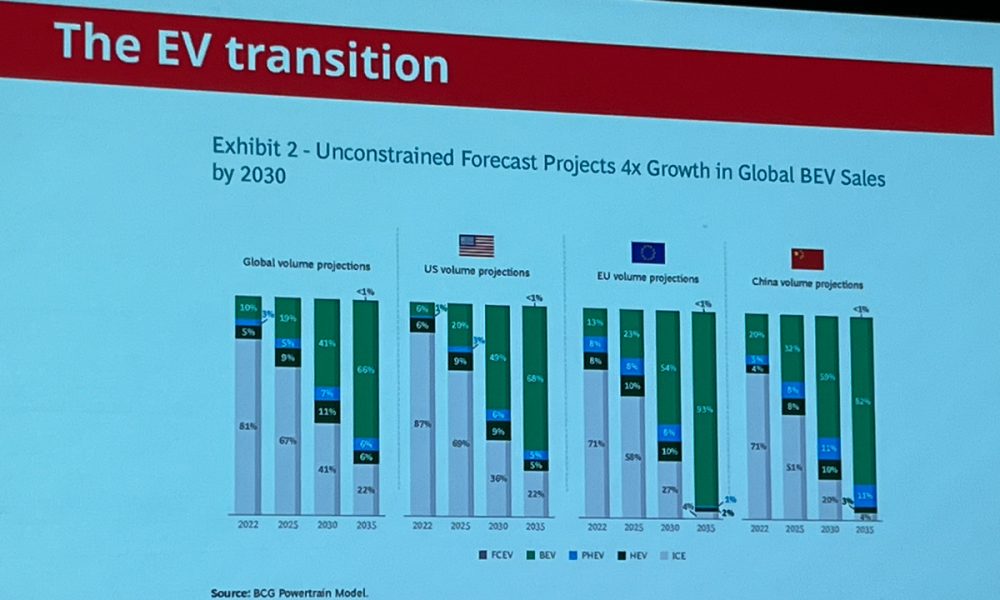

Kingston said that while it’s hard to accurately estimate EV growth, the association predicts a four-fold growth in EV sales by 2030, although he added that forecast is not constrained by mineral availability, or other limiting factors.

He said virtually every OEM has an aggressive EV target by 2030. “The speed of commitments to electrification by OEMs is nothing less than stunning,” said Kingston. The “Big Three” are committing $100 billion U.S. to EV development by 2030, he said. In 2012, there were only three EV models available in Canada. “As of today there are 77, and by next year we anticipate another 40 more models,” said Kingston.

In terms of hurdles constraining EV growth and adoption, Kingston presented a Road to 2035 ZEV timeline that showed a woeful lack of charging infrastructure that will be needed to improve if the federal government’s EV mandates are implemented. “We need more charging and we need it now,” said Kingston. “There is a huge gap in charging and we don’t have a plan to get us to 2035.”

Affordability and charging infrastructure remain the key constraints consumers speak to about their EV hesitancy. “To not have a purchase incentive for consumers in Ontario is a real problem,” said Kingston, citing examples of how EV growth is sparked by government incentives in B.C. and Quebec.

The next speaker was Abhishek Bhatia, Head of EV Strategy and Transformation at Nissan Canada. Bhatia said Nissan has sold more than 1 million EVs globally and the company has been in the EV business for more than a decade. “During that time there have been lots of learnings,” said Bhatia. “More than a decade ago, our customers were pioneers.”

Bhatia said the company has taken its learning from their pioneers as EV usage and trends have shifted, most notably away from sedans and into SUV style vehicles.

A panel of experts then tackled the topic of leasing and financing a new car. Bob Metodiev from Inovatec Systems was the moderator, and panelists were Tara Powadiuk, Director of Product of Volvo Canada; Annie Deslauriers, VP of Customer Experience and Operations at Sym-Tech Dealer Services; Krishnan Mani, Manager of Financial Service at Lucid Motors; and Rob Hodge, VP of Remarketing with VW Credit Canada.

Tara Powadiuk said Volvo transitioned to building everything from a customer-centric approach.

Lucid’s Krishnan Mani said his company’s direct-to-consumer model, without a dealer network, means having to rethink the car buying and ownership experience. “You put technology first and let the consumers engage the way they want at every stage of the purchase experience,” said Mani.

Annie Deslauriers from Sym-Tech said the pandemic drove the industry to innovate and become more customer focused in their approach. “We now talk about the F&I products ahead of time,” said Deslauriers. “Now we are having conversations with customers about F&I products in the comfort of their own homes.”

Rob Hodge, VP Remarketing VW Credit Canada, said there will be growing pressures on lending approvals from financial institutions, and leasing will now become more of an option.

Thomas Feltmate, Senior Economist at TD Bank, provided an economic update. Feltmate talked about the supply chain challenges and the growth in EV production and investment. Feltmate said consumer spending in the U.S. is up sharply despite sky-high interest rates.

Darren Slind, Co-Founder and Managing Director of the Clarify Group, provided his insights about the evolution of the auto dealer in an era of disruption. Slind said he was offering his perspective through the lens of dealers. He cited a quote from a Forbes magazine article: “Disruption is rarely invited to an industry,” he said. But the auto industry, like it or not, is being disrupted and will continue to be.

To put that disruption in perspective, however, Slind presented a slide that outlined the potential risks that dealers were facing from disruption, the likelihood of which disruptions will happen, and the potential impacts if dealers do not respond effectively. The sobering message was that dealers can’t ignore or resist the changes, they need to embrace them.

Slind also talked about the changing customer expectations for the consumer experience, some of which was accelerated by the pandemic, but many of those forces were already in motion. He said when consumers enjoy a transparent experience that delivers them value outside of automotive, they can’t help but then ask: “why can’t my dealer do that for me?”

Slind also presented a global view of the move to electrification. “The basic message is the train has left the station already,” said Slind, adding it’s no longer a question of “if” we make the transition to vehicle electrification, it’s mostly just a question of “when” for dealerships.

TV personality Stephanie Henry moderated a lively panel on the changing customer journey that tackled the changing consumer experience, a more digital sales and dealership experience, and the need for more education to help wary consumers better understand and embrace electric vehicles.

A panel session, moderated by Todd Phillips, Editor of Canadian auto dealer (and a founding member of Accelerate Auto), tackled the need for more intentionality by the auto industry in creating more opportunities for the next generation of Black talent entering the industry, while providing mentoring and career growth for those already in the industry.

The panelists were: Jerry Chinner, Executive Chair of Corporate Partnerships, Founding Member, Accelerate Auto and VP Business Development with taq Automotive Intelligence; Alannah David-Clark, Senior Manager, Marketing Communications at Nissan Canada; and Anne Marie Desando, Vice President National Sales, Scotiabank.

The panelists shared their personal stories of their journey in automotive, the challenges they see in industry for more diversity and inclusion, the start of a new pilot mentorship program created by Accelerate Auto, the importance of allyship and things people and organizations can do right now to make a positive impact.

The closing keynote was delivered by Elias El-Achhab, Vice President and COO, Kia Canada, who delivered a thoughtful perspective on changes to the industry, Kia’s growth and popularity among dealers looking to acquire a new franchise. He said the industry must move more quickly to embrace the transition to electrification.

The event emcee was Bri Newman, Vice-President of HR4.