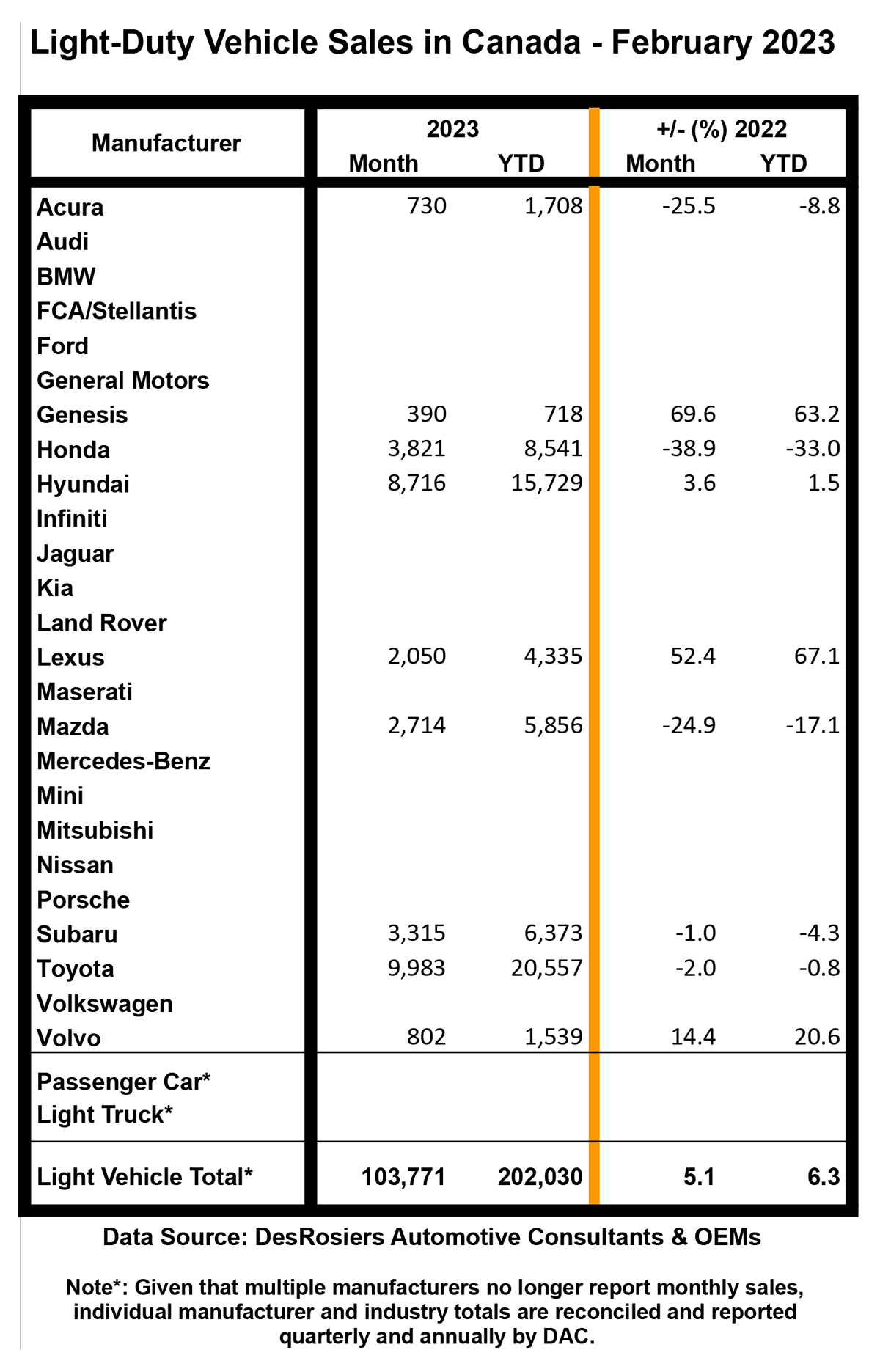

Is the glass half-full or half-empty? That is the question prompted by February’s new-vehicle sales numbers in Canada. Sales of 103,771 vehicles, as estimated by DesRosiers Automotive consultants, were up by 5.1% from February of last year. Following a 7.5% increase in January, that gain makes four consecutive months of year-over-year sales improvements, which is an encouraging sign.

Year-to-date sales of 202,030 units through the first two months of 2023 are 6.3% ahead of a year ago.

Further promoting the glass-half-full perspective, February’s SAAR (Seasonally Adjusted Annualized Sales Rate) of 1.70-million for February, according to DAC, was the second best for any month since July of 2021.

While those numbers are directionally positive, they are far from a dramatic turnaround, however. February’s sales were not improved as much as January’s, relative to a year ago. And they were the second-lowest for the month in the past ten years. From that perspective, the glass still looks half-empty.

Looking forward, the breadth of improved vehicle availability is gradually widening and consumer spending remains resilient, observed Andrew King, Managing Partner of DAC.

We’re still looking at the “supply story,” both here and in the U.S., where limited inventory has been holding back sales, said Rebekah Young, Director, Fiscal and Provincial Economics at Scotiabank. She added that Scotiabank has “pencilled in” a forecast of 1.65 million vehicles for 2023.

If achieved, that figure would be a solid 10 per cent increase from 2022, while still more than 10 per cent below pre-pandemic norms. Half-full or half-empty?

Winners and losers

With the now usual caveat that reported sales numbers for any manufacturer may reflect its product availability as much as market demand alone, here are the winners and losers of automakers who have reported sales for February.

Of those automakers reporting February results, Genesis topped the charts in terms of percentage gain from the same month last year, up 69.6%. Lexus wasn’t far behind at 52.4%, followed by Volvo at 14.4% and Hyundai at 3.6%.

Those reporting February sales declines included Subaru (-1.0%), Toyota (-2.0%), Mazda (-24.9%). Acura (-25.5%) and, with the greatest decline, Honda, down by 38.9%.

Given that many automakers continue to report sales only quarterly rather than monthly, a complete breakdown of results by manufacturer will be available after the first quarter.