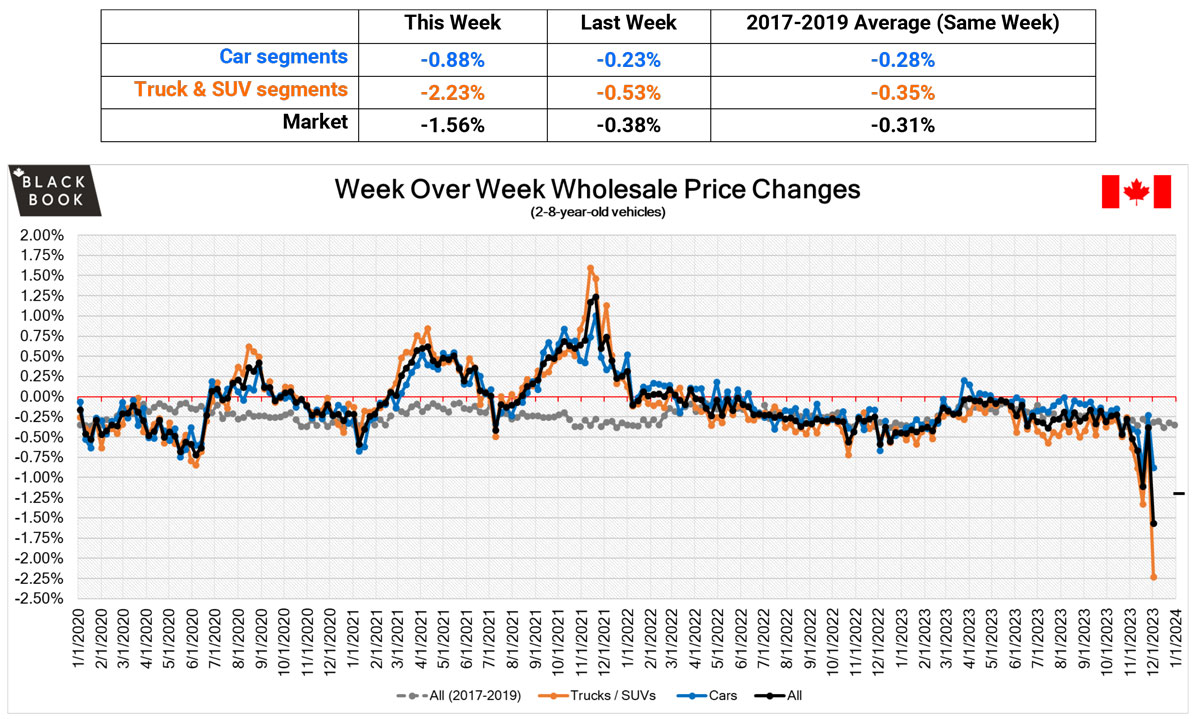

The Canadian used wholesale market saw its largest decline in prices yet, at –1.56%, for the period ending on Dec. 2. The prior week’s decline was only -0.38%, and Canadian Black Book’s Market Insights data indicates that the 2017-2019 average of the same week, a mere -0.31% in comparison, was significantly less steep.

Segment-specific, cars fell by -0.88% (compared to -0.23% the prior week), and truck/SUV segment prices declined –2.23% (compared to -0.53% the previous period). Not a single segment’s value increased for the week. In its report, CBB said the Canadian market “continued to decrease, and the overall decrease was the largest seen this year and more than six times the historical average.”

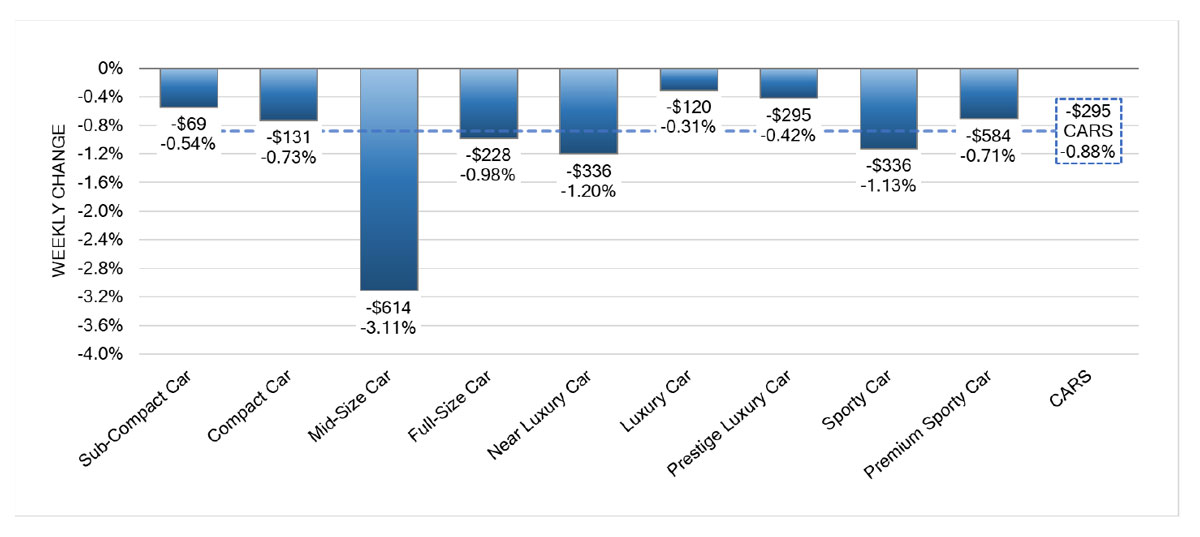

In the cars category, mid-size cars experienced the most significant decline in pricing (-3.11%), followed by near-luxury cars (-1.20%) and sports cars at (-1.13%). For trucks/SUVs, four segments had a 3% or greater depreciation: compact luxury crossovers/SUVs (-3.57%), compact crossovers/SUVs (-3.56%), full-size luxury crossovers/SUVs (-3.42%) and mid-size crossovers/SUVs (-3.00%).

CBB said supply remains low and demand for vehicles at auction on both sides of the border is decreasing. They also noted that upstream channels continue to tap into that supply before it can be made available to wholesale market.

“Most segments saw a change in average value of more than $100 this week as the truck and SUV segments fell the most,” said CBB. “We see that smaller vehicles have been outperforming their larger alternatives, as possibly both Canadian consumer budgets tighten and arbitrage risk to exporters continues to rise.”

They also noted that conversion rates were “quite low” during this reporting period, with some observed sell rates as low as 9% or as high as 49%. However, most were less than 30%. “Last week we saw less sellers dropping floors, which has been contributing to lanes with lower sell rates.”

You can read the full CBB report here.