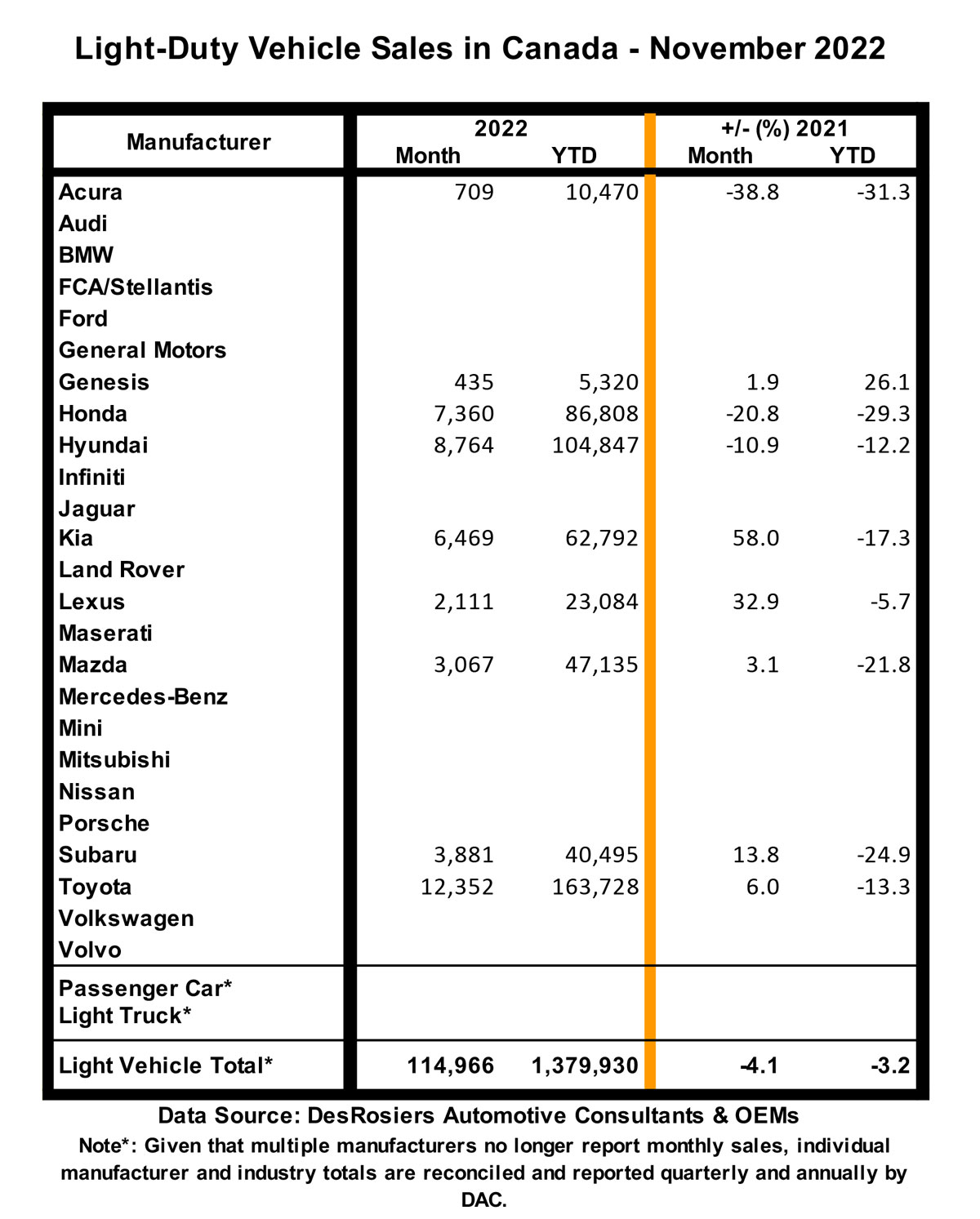

For the first time since last January, November auto sales in Canada outpaced those of the same month a year earlier. Sales of 114,966 units, as estimated by DesRosiers Automotive Consultants (DAC), were up by 4.1% from November 2021.

Could this accomplishment finally signal a turning point in the longstanding challenge of production constraints due to supply-side limitations? Maybe, but not necessarily.

As DAC points out, the comparable of November 2021 was a noticeably weak month with sales of only 110,448 units – compared to a market of 143,315 units in pre-pandemic November 2019 and 128,351 in 2020. So 2022’s modest gain hardly constitutes a rebound.

That perspective is reinforced by November’s SAAR (Seasonally Adjusted Annualized Sales Rate) of just 1.51-million, according to DAC – about where it has been for the previous two months.

Still, even a modest gain is better than a decline. And it offers some hope that the bottom may have been reached.

Unfortunately, even if that is the case, with current year-to-date sales of just 1.38-million it is unlikely that full-year sales in 2022 will reach 1.5-million. “If this is indeed the case,” says Andrew King, Managing Partner of DAC, “it will be the first year the market has fallen below this threshold since 2009.”

Looking forward to 2023, Laura Gu of Scotiabank Economics says, “We expect the sales rate in Canada to reach 1.65-million – still below fundamental demand – but with considerable bandwidths around those figures in light of economic (and policy) uncertainty, layered on top of weak sight lines on auto production plans.”

Winners and losers

With the caveat that we are still in a period where product availability tends to dictate sales performance of individual manufacturers as much or more than market demand alone, here is an overview of November, 2022 sales for those automakers who have reported.

Kia led the charts in terms of percentage gain, up 58.0% from the same month a year ago, with year-to-date sales down by 17.3%.

Lexus followed with sales up 32.9% in November and down 5.7% for the year-to-date, followed by Subaru (+13.8% Nov / -24.9% YTD), Toyota (+6.0% / -13.3%), Mazda (+3.1% / -21.8%) and Genesis (+1.9% / +26.1%).

The two other reporting brands’ November sales fell short of their year-ago figures with Hyundai’s numbers down by 10.9% (-12.2% YTD) and Acura’s down by 38.8% (-31.3%YTD).

A complete breakdown of results by manufacturer will be available at the end of year.