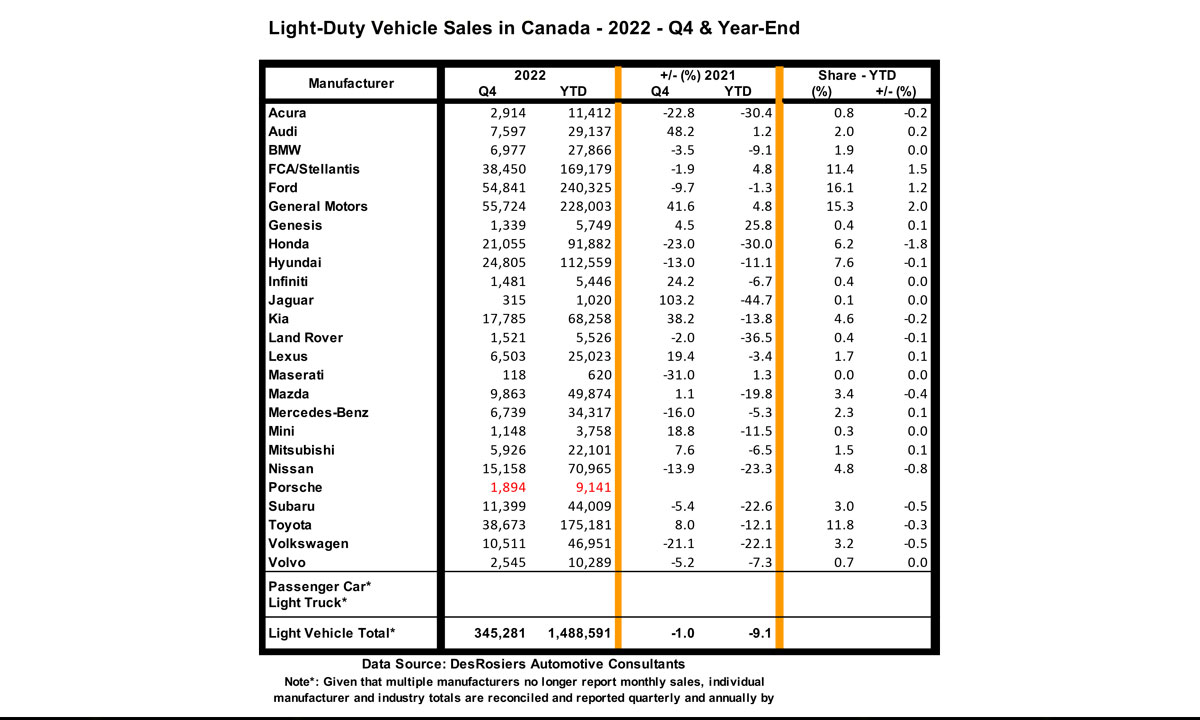

Not all the automakers have reported 2022 year-end sales yet, but we’re close enough to a final number to know that it will fall short of 1.5-million, probably somewhere very close to 1,488,600 units. DesRosiers Automotive Consultants (DAC) have estimated it at a rounded-off 1.49-million.

That is at least a 9.1% decline from last year’s abysmal numbers, and even 3.2% below peak-pandemic 2020, making it the poorest sales performance year since 2009.

We have known it was coming, but that doesn’t lessen the impact. Still, it might have been worse. Significant supply-side shortages kept inventories low throughout the year, which made it a sellers’ market, so profits tended to remain strong in spite of the sales declines.

Providing at least one positive note, December 2022 sales were a healthy 5.5% ahead of those for December last year, which was itself a relatively strong month. That robust finish brought Q4 sales to within 1.0% of those from a year ago.

In addition, the SAAR (Seasonally Adjusted Annualized Sales Rate) for December was about 1.65-million – the highest it has been since last January and a significant improvement from the sub-1.5 million level that has prevailed since March.

It is a single data point, but one that does provide hope that this long period of relative stagnation may be coming to an end – unless it is overwhelmed by the expected oncoming recession.

(Note: All numbers discussed here are exclusive of Tesla sales as that company does not report.)

Detroit Three make gains

As we have noted in sales reports throughout the year, given the ongoing supply-side constraints and their effects on production throughout the industry, sales numbers for any manufacturer may be a reflection of product availability rather than market demand alone. Still, the end results are a reflection of how well each automaker has been able to deal with those multiple influences.

For the 14th consecutive year, Ford retained its number-one sales ranking, with 240,325 units sold – a modest decline of 1.3% from 2021 in a market that was down 9.1%. As a result, the brand gained 1.2% of market share, to top the industry at 16.1%.

An impressive 41.6% sales surge in Q4 boosted General Motors’ full-year sales to 4.8% ahead of 2021, ensuring its second-place ranking with 228,000 units sold. As a result, GM’s market share increased by 2.0% to 15.3% – the greatest share gain in the industry.

Toyota, with or without Lexus sales included, claimed third place in the rankings, selling 175,181 Toyota-brand vehicles in the year, a 12.1% decline that cut its market share by 0.3%, to 11.8%.

Stellantis, in fourth place, increased its annual sales by 4.8% from 2021, to 169,179 units, bumping market share up by 1.5% from 2021, to 11.4%.

Hyundai consolidated its fifth-place ranking with sales of 112,559 new vehicles, down by 11.1%, resulting in a 0.1% market share decline to 7.6%.

Tight races further down

After falling to sixth place earlier in the year, Honda retained that ranking at year-end with sales of 91,882 vehicles, a 30.0% year-over-year decline that cut its market share by 1.8% to 6.2% – the greatest share decline in the industry.

After being surpassed by Kia for seventh place earlier in the year, Nissan regained that position at year-end with 70,965 total sales, a 23.3% decline that reduced the brand’s market share by 0.8% to 4.8%.

Kia finished the year not far behind in eighth with 68,258 sales, a decline of 13.8% and 0.2 % of market share, reducing it to 4.6%.

Mazda and Volkswagen scrapped over ninth place throughout the year with Mazda claiming the spot at year-end on total sales of 49,874 vehicles, a 19.8% decline, resulting in a 0.4% loss of market share to 3.4%.

Volkswagen was close behind in tenth with 46,951 vehicles sold, down 22.1% from 2021. As a result, VW’s market share fell by 0.5% to 3.2%.

Subaru remained 11th in the rankings, about 3,000 units back, followed by Mercedes-Benz, which continued to head the luxury brand rankings, ahead of Audi, BMW, and Lexus in that order.

Winners and losers

As it did throughout much of the year, Genesis finished 2022 with the greatest sales increase in percentage terms, up 25.8% from a year ago. It was followed by General Motors and FCA/Stellantis (both +4.8%), Maserati (+1.3%) and Audi (+1.2%), the only brands to make absolute gains.

At the other extreme, Jaguar experienced the greatest percentage decline (-44.7%), followed by Land Rover (-36.5%), Acura (-30.4%), Honda (-30.0%), Nissan (-23.3%), Subaru (-22.6%), and Volkswagen (-22.1%).