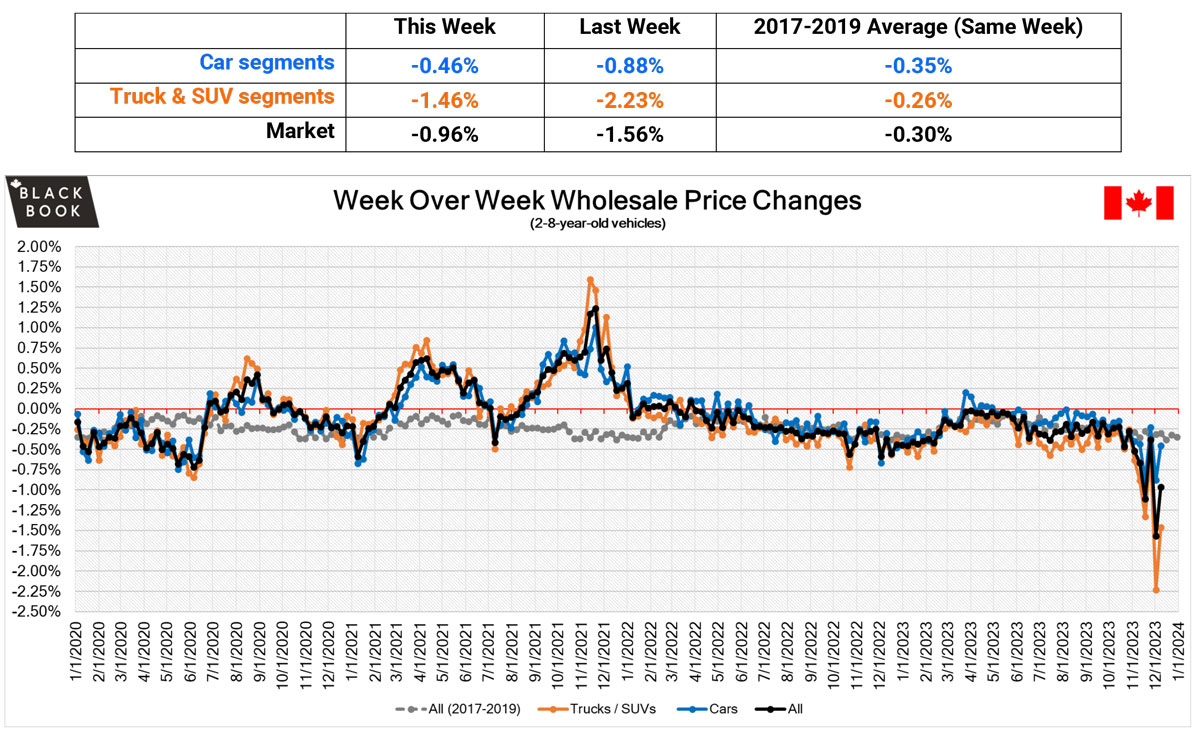

With a decline less steep than the prior week’s -1.56%, the Canadian used wholesale market saw prices drop -0.96% for the period ending on Dec. 9, according to Canadian Black Book’s latest Market Insights report.

This time the car segment fell by -0.46% compared to -0.88% the prior week, and truck/SUV segment prices were down –1.46% compared to the last reporting period’s -2.23%. All declines are still more than the 2017-2019 average of the same week, including for the overall market. Two out of 22 segments’ values increased for the week.

“The Canadian market continued to decrease, and the overall decrease continues the high level of declines more than the historical average,” said CBB in its update. “Supply is building with decreasing demand for vehicles at auction on both sides of the border. Upstream channels continue to tap supply before it can be available to wholesale markets.”

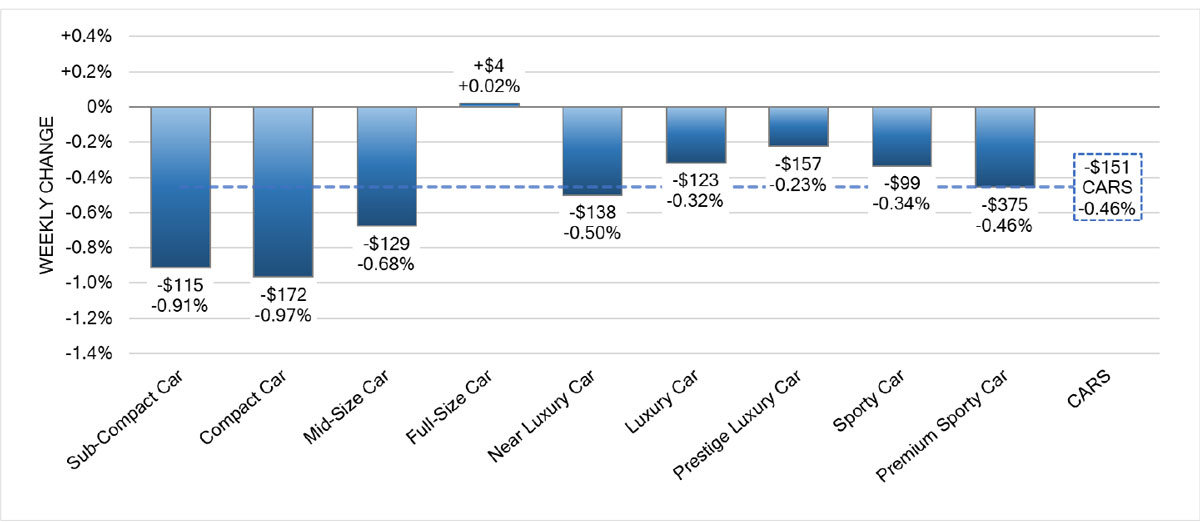

All but one of the nine car segments experienced a decrease. Full-size cars managed an increase in pricing of +0.02%, whereas compact cars showed the most significant decrease with a -0.97% drop in pricing. That was followed by sub-compact cars (-0.91%) and mid-size cars (-0.68%).

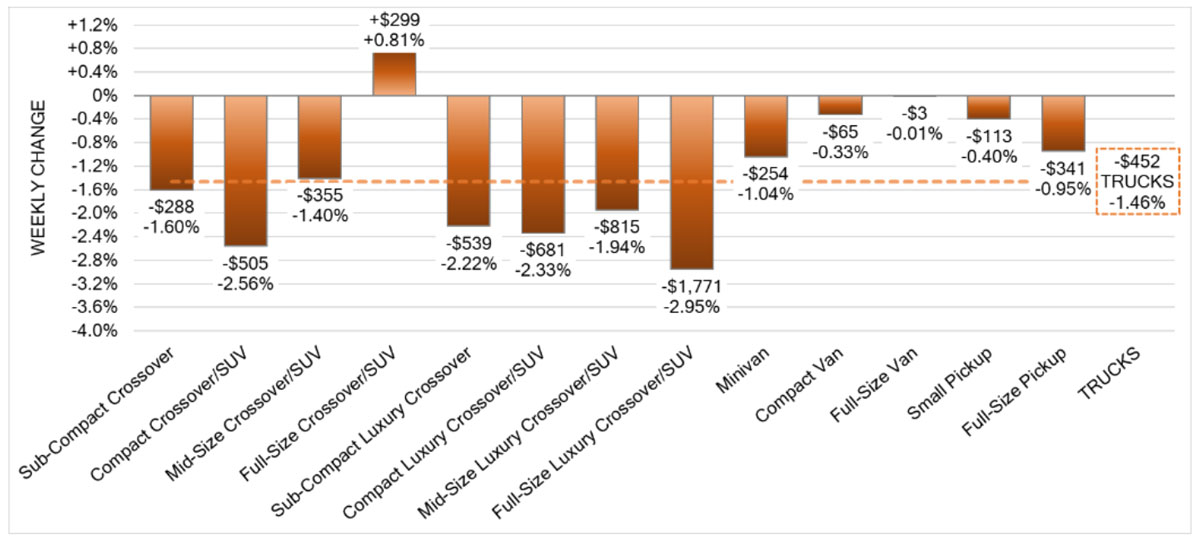

Like cars, all segments but one under trucks/SUVs experienced a decrease in pricing during this reporting period. The segments with the largest depreciation were full-size luxury crossovers/SUVs (-2.95%), compact crossovers/SUVs (-2.56%) and compact luxury crossovers/SUVs (-2.33%). The single increase came from full-size crossovers/SUVs (+0.81%).

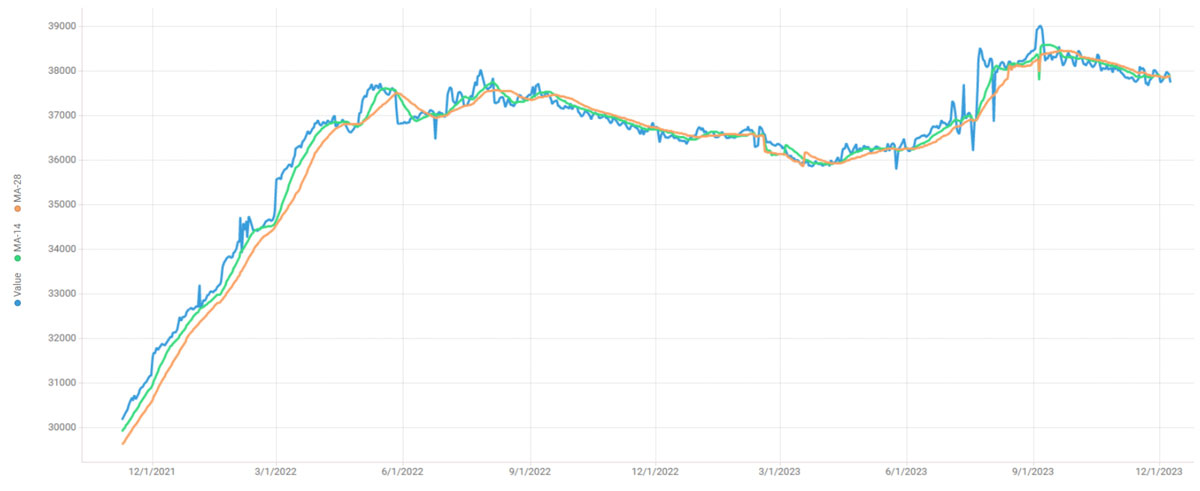

The average listing price for used vehicles, as per the 14-day moving average, was approximately $37,875. The analysis is based on around 210,000 vehicles listed for sale on Canadian dealer lots, according to CBB.

The full report is available here.