Few Canadian provinces are investing in consumer incentives for EVs. It’s time to change that.

The good news: The number of Zero Emission Vehicles (ZEVs) in Canadian driveways grew by 58 per cent in 2021 according to a recent Automotive Insights report from IHS Markit.

The bad news: ZEVs still only represent 1 in every 20 new vehicles sold in Canada (5.6 per cent) in 2021 according to the same report.

Transport Canada uses the term ZEV to describe vehicles that can operate without producing tailpipe emissions. ZEVs therefore include battery electric (BEV), plug-in hybrid electric (PHEV), and hydrogen fuel cell (FCEV) vehicles.

The Canadian government is committed to reaching 100 per cent ZEV sales by 2035, not dissimilar to aggressive targets set by the US, UK and Germany. Convincing the other 19 in 20 Canadian new vehicle buyers to switch from the routine and comfort of a combustion vehicle feels like a very tall order given the transition runway is only 13 years away.

There are some positive signs.

2022 will bring the introduction of new ZEV models in the segments Canadians care most about—utilities, crossovers and pickup trucks—and from manufacturers and local dealers they know and trust.

So-called legacy manufacturers like Ford (Mustang Mach-E), Hyundai (Ioniq 5), Kia (EV6), Nissan (Ariya), Volkswagen (ID.4) and Porsche (Taycan) have already launched ZEV models to critical media and consumer acclaim. Providing meaningful choices for consumers “beyond Tesla” is critical to ZEV adoption. Even Elon Musk agrees with this assertion.

We are also seeing promising signs that OEMs are moving to adopt software-driven product development practices similar to Tesla. The days of discrete and unchanging vehicle features by model year don’t exist in the ZEV world.

Ford’s recent announcement the company is separating the traditional combustion (Ford Blue) and electric (Ford Model e) businesses into separate divisions is emblematic of the need to bring continuous innovation to consumers in real time. When Canadians realize that some aspects of their vehicle actually improve over time, ZEV adoption will accelerate.

But significant challenges remain including:

- Weak consumer knowledge and low engagement—recent data from Clarify’s State of Charge EV Monitor confirms the digital engagement of Canadians on the topic of electric vehicles is only a fraction (one third) of the level of overall automotive topic engagement.

- Range anxiety—with many BEVs now offering 400 kms or more on a single charge, range anxiety may be more imaginary than real, but this perception nevertheless prevents some Canadians from seriously considering ZEV options.

- Charging infrastructure—more precisely the lack of visible public charging options (with the possible exception of Tesla’s supercharging network) and poor reliability of charging stations currently installed.

- Affordability—According to Clarify’s State of Charge EV Monitor, nearly 60 per cent of Canadian households have annual incomes below $100,000. Until ZEVs are readily available at price points under $40,000 (new and pre-owned), engagement and adoption for most Canadians will remain low.

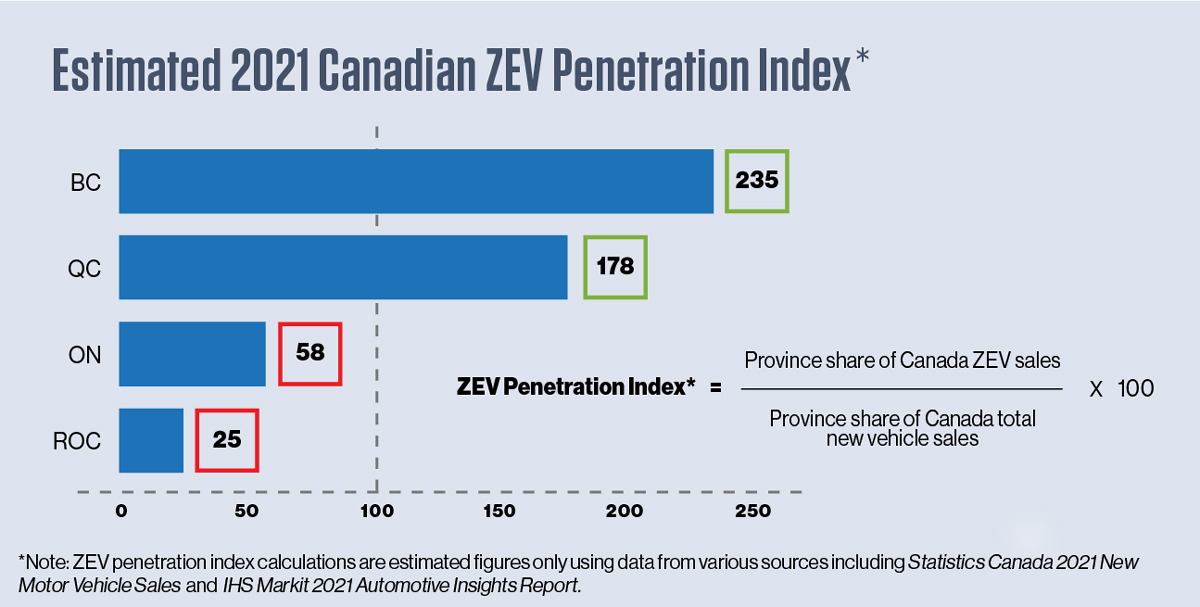

Another significant challenge in meeting the 2035 ZEV target is that 80 per cent of provinces are not in the ZEV game. In fact, 71 per cent of all ZEVs sold in Canada last year were in BC and Quebec. This is as good an example of the 80/20 rule as you are likely to find.

Ontario is of particular concern. Canada’s largest province delivers nearly 40 per cent of total new vehicle sales annually. Yet only 3.3 per cent of Ontario’s 664,000 new vehicle deliveries were ZEVs in 2021 compared with 5.6 per cent nationally, 9.5 per cent in Quebec, and 13 per cent in B.C. With a largely urban and suburban population and with 91 per cent of the power grid coming from non-carbon emitting sources (2017 Canada Energy Regulator Landscape Report), Ontario has the potential to be a strong ZEV market.

But, while the Ontario government is actively pursuing investments in ZEV supply (raw materials, R&D, component parts and manufacturing), it has so far resisted making investments on the demand side. Strong consumer rebate programs in B.C. and Quebec are a key reason for their ZEV leadership.

2022 will bring the introduction of new ZEV models in the segments Canadians care most about—utilities, crossovers and pickup trucks

The extent of the “Ontario challenge” is starkly clear when comparing provincial ZEV performance in the form of a ZEV penetration index. At an estimated index of only 58, Ontario punches well below its super heavyweight class. In relative terms, with an estimated index of 235, middleweight B.C. outperforms Ontario by a factor of four.

While the ZEV sales situation in the other seven provinces (rest of Canada) is even worse with an estimated penetration index of only 25, the reality is that Canada cannot hope to achieve its 2035 target without a significantly different approach in Ontario.

While consumer rebates are not the only answer, they are a key means of temporarily bridging the affordability gap until ZEVs reach cost of ownership parity with ICE vehicles, and until consumers have more ZEV choices in affordable, high-demand segments like compact utilities.

Strong consumer rebate programs in B.C. and Quebec have accelerated the ZEV transition from “early adopters” to “early majority” buyers. The Maritime provinces have recently introduced rebate incentives. Ontario and the Prairie provinces—the ball is in your court.

As a wise mentor was fond of reminding me, hope is not a strategy.