But the sustainability of incentives raises questions about 2011

December’s sales results are not yet in, as we go to press. But barring a complete sales collapse in the final weeks of December, full-year sales will likely exceed 1.56 million units – perhaps even 1.57 million – up about seven percent from 2009.

December’s sales results are not yet in, as we go to press. But barring a complete sales collapse in the final weeks of December, full-year sales will likely exceed 1.56 million units – perhaps even 1.57 million – up about seven percent from 2009.

While that’s not a great result, it’s within two percent of the average sales over the past five years, so it’s not bad either. And the SAAR (Seasonally Adjusted Annual Rate) for the last few months of the year has been running even higher – in the 1.6-million range. So that bodes well for 2011’s prospects.

It would, at least, if it weren’t for the exorbitant level of incentives that is fuelling current sales – as much as $20,000 on some pickup trucks, according to Dennis DesRosiers of DesRosiers Automotive Consultants. The question now becomes, how long can the manufacturers keep up this pace of incentivization? They’re not sustainable is a common opinion.

But what will happen if those incentives are withdrawn, or even reduced significantly? Consumers have rightfully come to expect big incentives. The market has seldom been without them in recent years. So if they are curtailed, there is a good chance that buyers will just sit on their hands until they come around again.

All of which means the prospects for 2011 are less than certain. They will depend very much on how heavily manufacturers dip into the incentive trough, and for how long.

Trucks rule

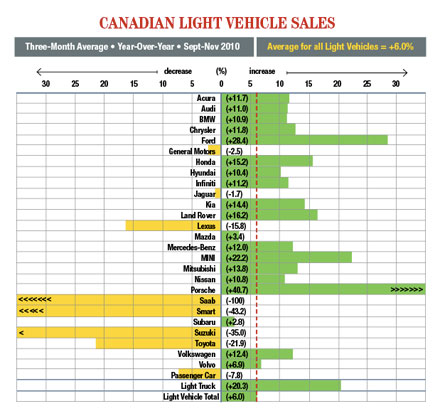

A driving force behind 2010’s sales strength was a resurgence in light truck sales. Year-to-date through November, they were up 19.9 percent over 2009, while passenger car sales were down by 4.9 percent.

With the exception of sports and luxury models, sales in all passenger-car segments were down – dramatically so at the bottom end of the market. Conversely there was strength throughout the light-truck segments, with only small vans showing fewer sales than in 2009, and them only marginally.

Through October, Large Luxury SUVs (+55.2%), Large SUVs (+37.3%), Large Vans (+36.9%), Intermediate SUVs (36.0%), Compact Utility Vehicles (+27.0%) and Large Pickup Trucks (+26.5%) led the charge on the truck side of the ledger, aided by strong incentives on many of those models.

Ford is #1

Buoyed by a strong increase in sales of the F-Series pickup, which continues to be the best-selling vehicle in Canada, and a 20-percent increase in total sales from 2009 (through November) Ford will surpass General Motors for the top sales spot in Canada, with Chrysler third and Toyota fourth.

Fifth place is still up for grabs as we go to press with just a few hundred vehicles separating Honda and Hyundai.

Other brands with big sales gains from 2009 (through November) were: Land Rover (+33.7%); Audi (+28.7%); Chrysler (+27.6%), Subaru (+20.7%); Porsche (+18.9%); Mercedes-Benz (+18.2%); Kia (+17.0%); and Infiniti (+16.2%).

On the other side of the ledger, Suzuki (-26.8%) and Smart (-23.2%) were the biggest losers, in percentage terms. But in terms of total numbers, Toyota (-13.9%) was by far the poorest performer, with sales down about 24,000 units from last year.

Final 2010 results

By the time you receive this magazine, final year-end sales results and their analyses will be published in our weekly e-Newsletter, Dealership Digest as well as on our website

www.canadianautodealer.ca. Because of the distorted comparison resulting from the low baseline set through most of 2009, in addition to year-over-year comparisons, our monthly reports now contain a column showing current-year sales, by manufacturer and in total, relative to their average for the past five years.